CNBC is the business news station that we tend to watch during the trading day, and they spent quite a bit of time examining the marijuana and cannabis sector this last week. After the remarks made by U.S. Attorney General Jeff Sessions, they provided increased coverage, focusing on stocks reacting negatively to the news release.

We are not concerned and do not believe that any of these states will use the Jeff Sessions remarks to alter existing, decriminalized policies in their states.

Not the First Time Jeff Sessions Stopped a Marijuana Sector Rally

This last week was not the first time Jeff Sessions put a stop to a marijuana sector rally. See this Seeking Alpha article, where we credit him with the early 2017 decline in the marijuana or cannabis sector, and provided the following:

"White House may boost recreational marijuana enforcement"

The comment from this last week is far less aggressive (see above). There is a big difference between “White House may boost…enforcement” (February 2017) and “let state attorneys decide” (January 2018).

They are respecting state rights, which is a theme Trump touted during the presidential election. Therefore, we view the most recent statement as FAVORABLE for the marijuana or cannabis sector.

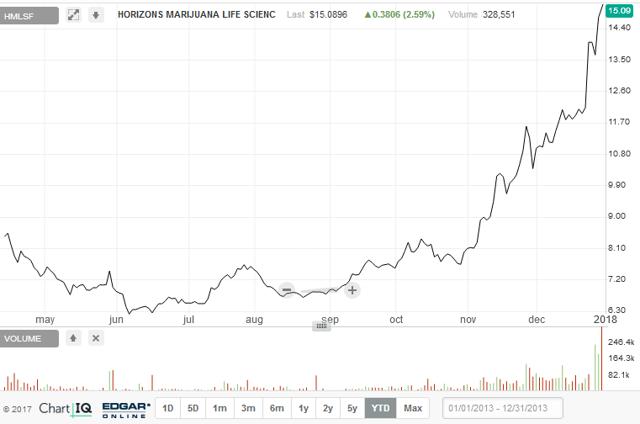

Note the detectable impact that the Jeff Sessions statement had on the Horizons Marijuana Life Sciences Index ETF (OTC:HMLSF) (see red arrow and red volume indicator in the below chart).

Note that a recovery is already in progress (see green volume indicator in the above chart).

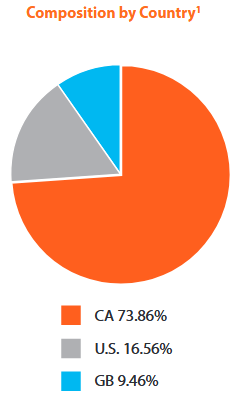

We like the Canadian exposure, which has not changed since the last Seeking Alpha article:

Canadian tickers have also not changed, and are listed below:

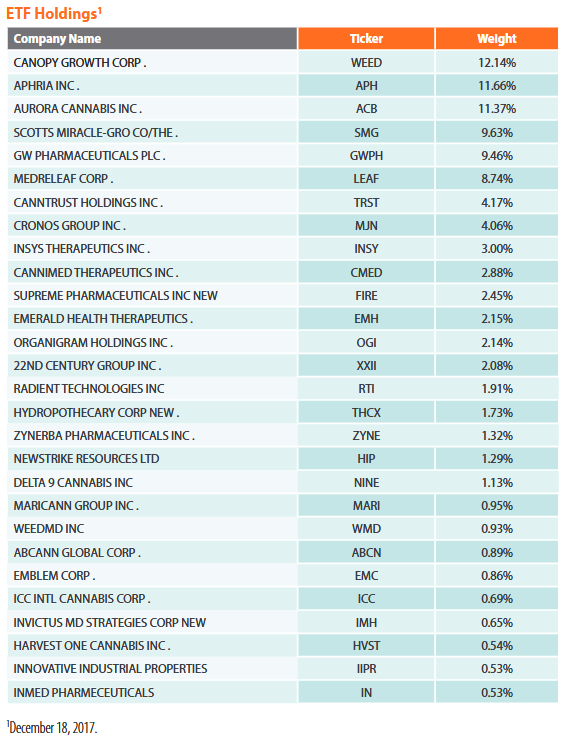

Therefore, U.S. tickers for the Horizons Marijuana Life Sciences Index ETF remain unchanged, and are listed below:

|

Name |

US Ticker |

Percent |

|

|

1 |

Canopy Growth Corp. |

12.14% |

|

|

2 |

Aphria Inc. |

11.66% |

|

|

3 |

Aurora Cannabis Inc. |

11.37% |

|

|

4 |

The Scotts Miracle-Gro Co. |

(SMG) |

9.63% |

|

5 |

GW Pharmaceuticals PLC. |

9.46% |

|

|

6 |

Medreleaf Corp. |

8.74% |

|

|

7 |

Cannitrust Holdings Inc. |

4.17% |

|

|

8 |

Cronos Group Inc. |

4.06% |

|

|

9 |

Insys Therapeutics Inc. |

(INSY) |

3.00% |

|

10 |

Cannimed Therapeutics Inc. |

2.88% |

|

|

11 |

Supreme Pharmaceuticals Inc NEW |

2.45% |

|

|

12 |

Emerald Health Therapeutics |

(TBQBF) |

2.15% |

|

13 |

Organigram Holdiings Inc. |

2.14% |

|

|

14 |

22nd Century Group Inc. |

(XXII) |

2.08% |

|

15 |

Radient Technologies Inc. |

1.91% |

|

|

16 |

Hydropothecary Corp. NEW |

1.73% |

|

|

17 |

Zynerba Pharmaceuticals Inc. |

(ZYNE) |

1.32% |

|

18 |

Newstrike Resources Ltd |

1.29% |

|

|

19 |

Delta 9 Cannabis Inc. |

1.13% |

|

|

20 |

Maricann Group Inc. |

0.95% |

|

|

21 |

WeedMD Inc. |

0.93% |

|

|

22 |

Abcann Global Corp. |

0.89% |

|

|

23 |

Emblem Corp. |

0.86% |

|

|

24 |

ICC Intl Cannabis Corp. |

0.69% |

|

|

25 |

Invictus MD Strategies Corp. NEW |

0.65% |

|

|

26 |

Harvest One Cannabis Inc. |

0.54% |

|

|

27 |

Innovative Industrial Properties |

(IIPR) |

0.53% |

|

28 |

Inmed Pharmaceuticals |

0.53% |

|

|

Total |

99.88% |