Welcome to our Weekly Cannabis Report, a reliable source for investors to receive the latest news, developments, and analysis for the cannabis sector.

Weekly Note To Readers

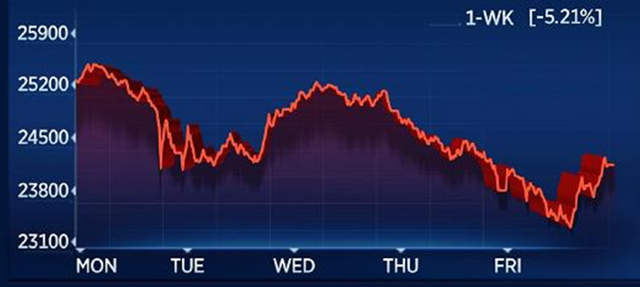

After a brutal week, investors finally got some breathing room as companies across the industry rallied despite broader equity market selloff. The cannabis sector exhibited little correlation with the broader equity market this past week which saw the Dow losing another 5%, making the cannabis sector one of the few sectors that posted gains for the week. We think the sector was able to avoid the general turmoil in the equity market due to a couple of potential reasons. Investors have had "nowhere to hide" in the equity market, and cannabis has somehow become a safe harbor for some. Cannabis space is also crowded with retail investors that might view the dip last week as a buying opportunity. The sector has not regained all of its losses yet, but last week showed a sign of stabilization. We think investors should view last week's correction as a healthy dose of reality for the market. Going forward investors should focus on finding companies that possess the highest likelihood of success post-legalization. The easy money has been made in the cannabis space, and we expect investors to start discerning top performers from the rest, and share price should reflect the shift in investor mindset over time.

(NASDAQ:CNBC)

Weekly Recap - Cannabis Index

This week we are also excited to introduce a revamped index comprised of 36 cannabis companies and ETFs. We have expanded our tracking index from 13 to 36 after receiving encouraging feedback from our readers. Going forward we will monitor share price performance and notable news for all companies included in our index. We also plan to start publishing articles regular that introduces new cannabis companies to our dedicated readers. Last week we published our report on Emerald Health: West Coast Cannabis Player with Biotech Focus, which we encourage you to check out.

- Top Gainer (Weekly): PUF Ventures (OTCPK:PUFXF) saw its share price soaring 40% in the past week.

- ETFs (Weekly): Horizons Life Sciences ETF (OTC:HMLSF) gained 14% while ETFMG Alternative Harvest (MJX) gained 5% in the last week, partially offsetting last week's loss of 28% and 19%, respectively.

- Total Market Value: The total market value of the Cannabis Index was $23.5 billion at the end of the week.

- Top Gainer (One Year): MYM Nutraceuticals (OTCQB:MYMMF) had the highest return in the last 12 months with a 1,073% increase to its share price.

- Top Loser (One Year): Emblem (OTCPK:EMMBF) had the worst performance after losing 56% in the last 12 months.

| Name | Ticker | Currency | Market Value | Price | Return 1W | Return 12M |

| Canopy Growth | (OTCPK:TWMJF) | C$ | $5,583 | $28.17 | 17% | 134% |

| Aurora Cannabis | (OTCQX:ACBFF) | C$ | $5,129 | $11.33 | 33% | 339% |

| Aphria | (OTCQB:APHQF) | C$ | $2,583 | $16.08 | 16% | 193% |

| MedReleaf | (OTCPK:MEDFF) | C$ | $1,796 | $18.00 | 14% | n.a. |

| Cronos Group | (OTCPK:PRMCF) | C$ | $1,401 | $9.20 | 34% | 318% |

| CanniMed | (OTC:CMMDF) | C$ | $862 | $35.30 | 33% | 192% |

| Emerald Health | (OTCQX:EMHTF) | C$ | $725 | $6.53 | 11% | 398% |

| Hydropothecary | (OTC:HYYDF) | C$ | $680 | $3.89 | 14% | n.a. |

| Supreme Cannabis | (OTCPK:SPRWF) | C$ | $530 | $2.13 | 8% | 19% |

| Organigram | (OTCQB:OGRMF) | C$ | $519 | $4.17 | 10% | 53% |

| ABcann Global | (OTCQB:ABCCF) | C$ | $436 | $2.76 | 14% | n.a. |

| Liberty Health Sciences | (OTCQX:LHSIF) | C$ | $415 | $1.46 | 3% | 11% |

| MYM Nutraceuticals | (OTCQB:MYMMF) | C$ | $266 | $2.64 | 6% | 1073% |

| MPX Bioceutical | (OTCQB:MPXEF) | C$ | $248 | $0.71 | 3% | (11%) |

| Cannabix Technologies | (OTCPK:BLOZF) | C$ | $246 | $2.69 | 29% | 241% |

| Weedmd | (OTC:WDDMF) | C$ | $223 | $2.30 | 8% | n.a. |

| CannaRoyalty | (OTCQX:CNNRF) | C$ | $187 | $4.05 | 6% | 35% |

| Emblem | (OTCPK:EMMBF) | C$ | $181 | $1.62 | 5% | (56%) |

| Golden Leaf | (OTCQB:GLDFF) | C$ | $165 | $0.38 | 7% | (1%) |

| Maple Leaf Green World | (OTCQB:MGWFF) | C$ | $162 | $1.09 | 24% | 60% |

| THC Biomed | (OTCQB:THCBF) | C$ | $160 | $1.41 | 7% | 78% |

| InMed Pharmaceuticals | (OTCQB:IMLFF) | C$ | $154 | $1.17 | 26% | 225% |

| Nutritional High | (OTCQB:SPLIF) | C$ | $141 | $0.56 | 15% | 155% |

| Tetra Bio-Pharma | (OTCQB:TBPMF) | C$ | $127 | $1.00 | (2%) | 92% |

| Wildflower Marijuana | (OTC:WLDFF) | C$ | $93 | $1.74 | 15% | 500% |

| Lifestyle Delivery Systems | (OTCQB:LDSYF) | C$ | $88 | $0.82 | 9% | 24% |

| Beleave | (OTCQX:BLEVF) | C$ | $88 | $2.21 | 11% | 28% |

| Marapharm Ventures | (OTCQX:MRPHF) | C$ | $79 | $0.79 | (4%) | (36%) |

| PUF Ventures | (OTCPK:PUFXF) | C$ | $63 | $1.20 | 40% | 314% |

| Canada House Wellness | (OTC:SARSD) | C$ | $55 | $0.45 | 29% | 48% |

| Friday Night | (OTCQB:TGIFF) | C$ | $38 | $0.74 | 14% | n.a. |

| Naturally Splendid | (OTCQB:NSPDF) | C$ | $31 | $0.32 | 10% | (2%) |

| Veritas Pharma | (OTCPK:VRTHF) | C$ | $29 | $0.57 | 4% | 33% |

| Canadian Cannabis | (OTCPK:CCAN) | C$ | $14 | $0.45 | 2% | (33%) |

| Horizons Marijuana Life Sciences Index ETF | (OTC:HMLSF) | C$ | $719 | $18.81 | 14% | n.a. |

| ETFMG Alternative Harvest ETF | (MJX) | US$ | $383 | $32.03 | 5% | 18% |

Developments and Sector Update

First Actively Managed Marijuana ETF Launched

Redwood Asset Management, a subsidiary of Purpose Investments (founded by Canadian ETF pioneer Som Seif in 2013), launched its Marijuana Opportunities Fund on Thursday morning. The ETF trades under "MJJ" on the Canadian exchanges (OTC listing not yet available). The current holdings of the fund include the following companies:

| Aurora Cannabis Inc (OTCQX:ACBFF) |

| CanniMed Therapeutics Inc (OTC:CMMDF) |

| Canopy Growth Corp (OTCPK:TWMJF) |

| Emerald Health Therapeutics Inc (OTCQX:EMHTF) |

| Hydropothecary Corp (OTC:HYYDF) |

| Indiva Ltd (OTC:RMKXD) |

| Invictus MD Strategies Corp (OTCPK:IVITF) |

| MedReleaf Corp (OTCPK:MEDFF) |

| Organigram Holdings Inc (OTCQB:OGRMF) |

| Village Farms International Inc (OTCQX:VFFIF) |

U.S. Marijuana ETF Risks Losing Its Custodian

As we wrote this past week that ETFMG Alternative Harvest ETF's current custodian, U.S. Bancorp, was reported to be reconsidering its business with the ETF. The marijuana ETF could face an abrupt closure if the institution charged with holding its assets (U.S. Bancorp) pulls the plug and a replacement isn’t found. We think the fund will be able to find another custodian if the bank were to drop it, and investors should not fret over the report but should keep a close eye on the development if you own the ETF.

Aurora Announced Investment into Liquor Stores

On Monday, Aurora Cannabis announced that it has made a strategic investment in Liquor Stores (OTCPK:LQSIF). As we discussed in our latest article, we think the investment showed Aurora's ambition to become the dominant player across the entire cannabis value chain (from production to retailing). However, it is interesting to note that Liquor Stores closed the day of announcement at C$11.92, a 20% discount to the price Aurora agreed to invest in, which was C$15. It shows that Liquor Stores shareholders remain skeptical of Aurora's plan and the market is not ready to play along, which is in clear contrast to how Aurora's past investments have been met in the market.

Cronos Announced Launch of Australian JV

On Monday, Cronos announced the launch of Cronos Australia Pty Ltd. (“Cronos Australia”). Cronos Australia is a 50/50 joint venture between Cronos and NewSouthern Capital Pty Ltd. In the announcement, the company also disclosed the grant of medicinal cannabis cultivation and research licenses to its Australia joint-venture. We note that the CEO of Cronos Australia, Rodney Cocks, has an impressive background with cannabis-related experience while working for UK Government’s Counter Narcotics team.

Additional Resources

We publish on cannabis-related topics regularly. Consider "follow us" to stay informed of the latest development and best ideas in the cannabis sector. We also encourage you to check out our recent work on the cannabis industry:

- Is Canopy Falling Behind Aurora?

- Best Way to Play the Cannabis Industry

- 5 Predictions For the Cannabis Industry

- The Complete Cannabis Guide #1 - Production Cost

- The Complete Cannabis Guide #2 - Production Capacity

- The Complete Cannabis Guide #3 - Consumption

Reprint From Seeking Alpha

About Marijuana Stock Reporting.net

MarijuanaStockReporting.net is

a subsidiary

of Target Publishing Inc, and is a leading publisher of

todays market and investment news, commentary,

proprietary research and videos from seasoned

journalists, analysts and contributors covering the

financial markets and global economies. We have been

paid by a third party to wite this article Leveraging

our extensive distribution network and social media

presence, we have cultivated

a valuable audience of

engaged market enthusiasts, which in turn

delivers a variety of unique oppXortunities

for industry partnerships, corporate communications,

market exposure and investment. The

article does not constitute investment advice. Each

reader is encouraged to consult with his or her

individual financial professional and any action a

reader takes as a result of information presented here

is his or her own responsibility.

A complete disclaimer can be viewed HERE