After a long period of darkness, Argentina has finally turned a corner as the nation continues to shift policies to attract foreign capital. It wasn't long ago that the government was moving to nationalize certain assets owned by foreign multinational corporations, while many companies sought to divest assets held in the country. Up until three years ago, the thought of Argentina playing a critical role in the development of the global energy storage industry would not have been taken seriously, especially by investors. Despite sitting on the most significant, low cost lithium brine deposits, only one project made it to market in the past 20 years. The lack of development in the Argentine lithium mining sector was not due to a lack of junior exploration companies, but rather low lithium carbonate pricing and difficulty financing projects. In the past two years, both of these challenges have been overcome due to the build out of the global electric vehicle industry and a shift in the Argentine political landscape. These shifts have already attracted significant global capital from junior lithium exploration companies to some of the largest global chemical companies, all looking to access lithium.

Until 2015, Argentina was led by Cristina Fernández de Kirchner and her populist government, making it difficult for foreign mining companies to conduct business in the country. High levels of inflation, currency control, and restrictions on the flow of capital ensured the Puna Plateau region remained under developed. For those unfamiliar, the Puna Plateau is a region within the Andes spanning 1,800km across Argentina, Bolivia, and Chile that reaches elevations of 4,000m. The Puna Plateau is often referred to as the "Saudi Arabia of lithium" as it holds approximately 70% of the global reserves.

An

Argentine flag

at Orocobre's site in the Lithium Triangle - 2017 Argentina

Lithium Tour

An

Argentine flag

at Orocobre's site in the Lithium Triangle - 2017 Argentina

Lithium Tour

For junior mining companies, such as Orocobre, the political landscape made it unnecessarily difficult to operate in the country. This ultimately led to construction cost overruns and delays in the production start-up. For Orocobre (OTC:OTCPK:OROCF) and their Joint Venture partner Toyota Tsusho (OTC:OTCPK:TYHOF), the situation has drastically shifted. The companies are now planning to invest another $160 million into expanding Stage 2 at their Olaroz facility. Furthermore, the Joint Venture is presently moving forward to build a lithium hydroxide facility in Japan and is undertaking initial discussions of a second facility, potentially in China. This is a clear signal to the market that Argentina can play a critical role to the global battery industry by becoming a secure supplier of low cost, high grade lithium carbonate. The only other major lithium investment in Argentina was the 2010 expansion project completed by FMC (NYSE:FMC) at their lithium brine, "Salar de Hombre Muerto", which saw annual output increase by 30% from 17,000 T LCE to 22,000 T LCE.

It is not only Orocobre and Toyota that feel confident investing under the current political landscape; the entire lithium industry generated over $1.5 billion in investments in 2016. Since the fall of the Kirchner government, lithium production has increased nearly 60% due to the commissioning of Orocobre's Olaroz lithium facility. It is now expected that Argentina will increase its annual output of lithium carbonate production to 145,000 T LCE by 2022. It is in my opinion that these numbers do not fully reflect the project development pipeline or the need for additional lithium carbonate beyond 2022. In the near term, Australia has moved to bring new lithium hard-rock assets to market, which is nearly double the cost of lithium produced from a brine asset such as in Argentina.

Brine

Pond At Olaroz - Argentina Lithium Tour 2017

Brine

Pond At Olaroz - Argentina Lithium Tour 2017

In basic terms, "brine" is highly concentrated water containing various salts and is located in salt lakes, or salars. The brine is extracted from below the Earth's surface, at depths between 200 to 400 metres, through a pumping system. The salt water is pumped in high volumes to form ponds above ground, which are then put through a multi-stage evaporation process that can take up to 12 months to complete. The remaining "clunky" white material is put through a processing facility that will purify the material to become battery-grade lithium carbonate. Additional minerals, such as lime, are added throughout the process to remove impurities in the brine, such as manganese. Beyond lithium batteries, there are various applications for lithium, including medicine, industrial greases, and glasses, so lithium carbonate is produced to meet the specifications of various end applications.

Under the Argentine constitution, the provincial government owns local minerals, which creates additional layers of complications. As an example, Orocobre successfully negotiated with the provincial Jujuy mining company, JEMSE, that ultimately took an equity position of 8.5%. JEMSE initially wanted 20% ownership in the Olaroz facility through a loan provided by the Joint Venture. Mauricio Macri and his leadership team are moving aggressively to shift the overall business environment in Argentina. In November 2017, I joined a group of analysts on a site tour of key lithium assets owned by Orocobre, Lithium Americas (OTCPK:LACDF), and Advantage Lithium (OTCPK:OTCQX:AVLIF). During the week-long program, the group listened to the Jujuy political leaders speak. The overall message was that the provincial government was dedicated to attracting foreign direct investment into the lithium industry and is fully committed to the group of active companies operating in the Jujuy province. These were very encouraging words considering one of the greatest dangers for foreign mining companies operating in Argentina is political risk. At a federal level, political economic actions allowed for more favorable currency controls, which devalued the Peso and started a shift towards scrapping export taxes. There have also been favorable actions towards maintaining and accessing information on land claims, harmonizing tax regulations, and standard royalty rates, which is clearly making it easier for exploration and existing mining companies to shorten development and construction timelines. The overall impact is that the world can expect some relief in the years ahead to bring meaningful lithium capacity to market.

Overlooking

the Buenos Aires train station - November 2017

Overlooking

the Buenos Aires train station - November 2017

Of course, one of the key topics within the business is whether the battery industry requires additional lithium carbonate and, if so, when the market would be prepared to absorb additional supply. Lithium prices have increased in the past few years from $5,000/T LCE to $11,000/T LCE by the end of 2017. Based on key pricing figures supplied by Orocobre and SQM, H1 2018 pricing for the white material has jumped to $13,000. In October 2017, Chinese domestic pricing was reported at greater than $18,000/T LCE. It is now expected that prices outside of China will "catch-up" to internal Chinese prices during 2018 and into 2019.

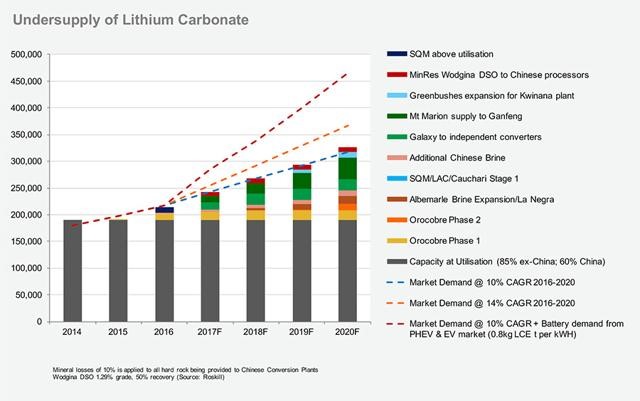

The following graph, "Undersupply of Lithium Carbonate", clearly illustrates that, on a base case scenario of EV penetration rates, new supply is required, which will primarily be brought on through the expansion of existing facilities rather than Greenfield projects. If the global adoption rate for EV penetration turns out to be more bullish than the base case scenario, then the battery manufacturing business will be in dire need of a dramatic increase in the supply of the white metal. It is in my opinion that other applications, such as stationary energy storage, electric buses, scooters, and the replacement of lead-acid batteries by lithium for starting-lighting-ignition applications within petrol-based vehicles will contribute to a market that is facing an undersupply of raw materials. The shift to lithium batteries in SLI battery applications could mean that a high percentage of all new vehicles on the road would require some source of lithium.

In the base case scenario, to meet demand, Argentina will see an increase from Orocobre's Olaroz facility from 17,500 T LCE to 42,000 T LCE. Lithium Americas, along with their project partners Ganfeng and SQM (NYSE:SQM), will introduce a total of 50,000 T LCE per year over two stages. Stage 1, at their Cauchari project, will introduce 25,000 T LCE per annum with meaningful volumes delivered in 2020-21. Between Orocobre, FMC (NYSE:FMC), and Lithium Americas, the total output of lithium from Argentina by 2020 should be over 80,000 T LCE per annum.

Looking beyond this group of miners, there are plenty of drills in the ground or scheduled to go into the ground over the next 12 months. Advantage Lithium(See: Advantage Lithium - A Must Own 2018 Lithium Junior), Lithium X(OTCMKTS:LIXXF), Neo Lithium (OTCMKTS:NTTHF)(See: Neo Lithium - Why I Recently Took A Position), LSC Lithium (OTCMKTS:LSSCF), and Millennial Lithium (OTCMKTS:MLNLF) are all well positioned to be the next group of lithium producers that will further increase output from Argentina beyond 2022. With only a small group of juniors, such as those listed above, the annual output could increase by around 100,000 T LCE, bringing Argentina's total annual production to over 180,000 T LCE. It is in my opinion that the global automotive industry will take longer to roll out electric vehicles due to the slow nature of the business, so the most bullish case illustrated below could be achieved in 2022 rather than 2020, meaning that the market could absorb another group of lithium juniors bringing new supply to market over the next five years.

In addition, it is becoming increasingly obvious that Orocobre intends to expand its operations into a third stage, which could be completed directly at Olaroz or through their sister company, Advantage Lithium. Orocobre ownsover 30% of Advantage Lithium and 25% of the Cauchari property. Lithium Americas has already expressed plans to build out their second stage at Cauchari for another 25,000 T LCE. It should also be considered that existing producers, such as FMC, SQM, and Albemarle, will not sit idle while the industry explodes around them. Albemarle is currently expanding its brine asset at La Negra, while SQM has taken a large position in Lithium Americas' Cauchari project. In 2017, FMC announced that it had taken up mining rights in Argentina to develop Greenfield lithium brine assets. Australian-based Galaxy Resources, a large lithium hard-rock producer, is also developing a lithium brine asset in Argentina.

By 2020, it should be expected that Argentina's lithium export could amount to 80,000 T LCE. Based on Greenfield projects in development, Argentina's annual production could more than double to 180,000 to 250,000 T LCE. Although much of this is pure speculation, the key focus will be on the uptake rates for new energy vehicles as this will be the primary source of demand for new supply. In the event that new demand does not continue to grow beyond 2020, then the industry could face an oversupply situation by as early as 2022. This would immediately cripple the Australian lithium hard-rock community as their operating costs are nearly double that of lithium produced from brine deposits. An oversupply scenario would likely lead to a consolidation of lithium producers in Argentina and Australia.

Regardless of the outcome around the supply and demand landscape over the next five to seven years, Argentina is attracting the necessary investments to ensure that existing producers are able to successfully scale their businesses while giving investors the confidence to plough hundreds of millions into drilling campaigns. This effort will ensure that the project pipeline for Greenfield lithium brine assets is full. It is in my opinion that the Argentine political landscape should remain consistent in the years ahead, which will allow for investors to continue to profit from rising stock prices in both junior explorers and producers.