A macrotrend is a trend that determines other trends. One of the biggest macrotrends in the last decade has been the emergence of renewable energy and electric vehicles, and up until now investors have mainly focused on putting money in Lithium or Cobalt. But there is another play on these developments that is far easier, and which has a far more reliable track record: copper.

The enthusiasm for copper is not really great at present, but that is precisely what I like: the time to buy copper is not when all are bullish on the material, but precisely when markets turn bleak. After a historical low of 2 dollars in the beginning of 2016, however, I believe that it is now safe to increase our exposure to this metal. And what better way to do this than through an innovative and eco-friendly project?

In this dossier you will find an analysis of the demand for copper, which is rising; the supply of copper, which is stagnating, but will probably even decline in the next decade; and the resulting economics of that equation. To give you just one fact: India, which is engaging in a massive scale electrification of its 1,35 billion population, will need as much copper as is produced in the world today. I simply cannot see how that could be bad for the red metal.

Copper prices nowadays are around 3 dollar.

This company will produce copper at 1,33 CAD.

A child can do the math.

Brecht Arnaert

Copper

Copper

is a chemical element with symbol Cu and atomic

number 29. It was one of the first metals to be

extracted, smelted and used by people, and has been

highly valued for over 10,000 years now. Yet, more

than 95% of all copper ever mined and smelted has

been from 1900 up to now, with the global demand

continuing to rise.

Copper

is a chemical element with symbol Cu and atomic

number 29. It was one of the first metals to be

extracted, smelted and used by people, and has been

highly valued for over 10,000 years now. Yet, more

than 95% of all copper ever mined and smelted has

been from 1900 up to now, with the global demand

continuing to rise.

Because of copper's multifaceted use and its necessity for infrastructure and transportation, it is essential in any period of innovation and growth. It has been considered an overall important economic indicator. So far, not a single sufficient replacement for copper has been found or created. Due to its conductivity, corrosion resistance and low thermal expansion, one of its biggest markets is electric wiring and telecommunication. It is also used in electronic devices, energy storage and power distribution stations, as well as a building and tubing material, and as a key component of transportation vehicles, among other things. Total world production is about 23 million metric tons per year. Copper demand is increasing by more than 575,000 tons annually and accelerating.

Demand

Copper is not only highly conductive and ductile, without which electrical equipment would need 20% more materials, but also 100% recyclable. It can be re-used without losing any of its engineering properties. All this has made it important in the race towards renewable energy. Due to the declining costs of alternative energy and the growing economic impact of the ecological focus in government legislation, we will only see the use of copper rise. A little known fact is that in general, clean energy sources (such as solar and wind) demand a copper usage that is up to six times more than fossil fuels.

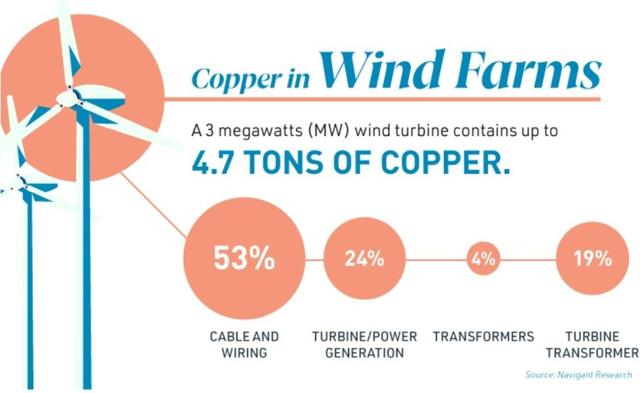

One wind turbine, for instance, needs up to 1000 kg (2204 lbs) of copper; onshore wind installations demand about 3522 kg (7766 lbs) of copper per megawatt, while offshore installations can reach up to 9555 kg (21,067 lbs) of copper per megawatt. Since 2004, about 177 billion dollars have been invested in large-scale U.S. wind projects.

About 5.5 tons of copper is needed per megawatt in solar power systems, while the costs of instalment have dropped by more than 70% over the last decade, which makes demand go up. We presume that overall instalment will continue to rise under heavy governmental incentive and promotion.

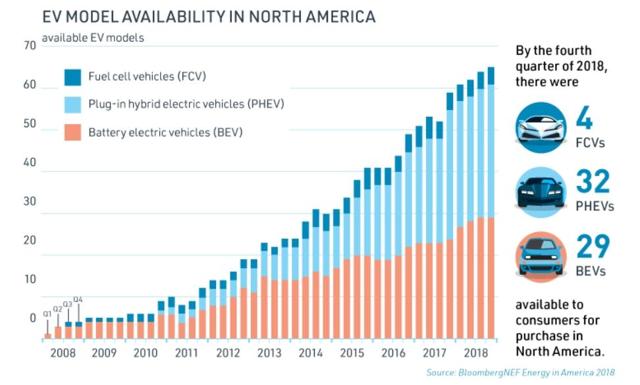

Renewable energy is not the only source of demand for copper. Electric vehicles are in need of copper for their motor coil, charging cables, and common copper compartments found in non-electric cars as well. One hybrid car consists of up to 38 kg (45 lbs) of copper, plug-in hybrids up to 60 kg (132 lbs), while a full-fletched battery electric vehicle reaches amounts of 83 kg (183 lbs) of copper. In 2016 alone, electric vehicle producer BYD (recently acquired by Warren Buffet) used around 11.7 million kg (or 26 million pounds) of copper, and for the U.S. it is projected that around 7 million EV’s will be on the road by 2025. If these numbers hold true, the 50,000 to 70,000 charging ports that are now public in the U.S. will have to increase by at least 2.23 million – all of which will need copper for their manufacturing as well.

Half a million tons of copper per year is not a small amount, and yet, the tendency towards renewable energy sources and alternative transportation could be adding an estimated extra half a million tons of demand on top of the growth we have already seen in the last couple of years. This demand is mainly to be expected from China and India.

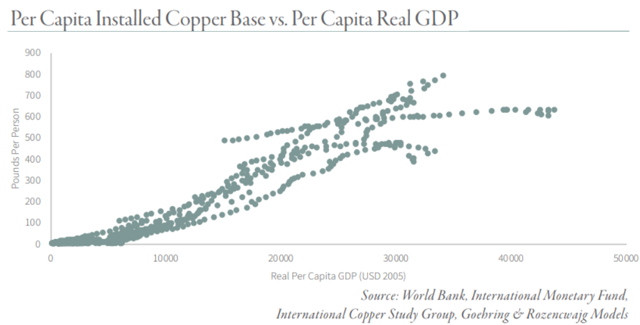

China, for starters, is responsible for about 50% of the world’s copper demand. The bearish analysis would be that China is overconsuming, since they are by far not responsible for 50% of the world’s GDP. This would mean their incredible demand is an anomaly, and will slow down in the coming years. This analysis, however, is based on the so-called “oil intensity” per unit of real GDP. That measure generally tells investors whether the growth of an economy is in the process of reaching a tipping point, after which it slows down again.

There is a fundamental difference between oil and copper, however. Oil gets consumed, and therefore needs to be replaced on a constant basis. Copper, on the other hand, is 100% recyclable – it gets installed intothe economy, and becomes part of the capital stock. It is therefore totally irrelevant to express copper’s annual consumption in relation to GDP. What we have to look at is at the total installed base of copper instead, and when we do, we see it correlate highly with the real GDP per capita; a trend that holds true across time and countries.

Any economy will need a certain copper stock to back itself long-term. China’s consumption of copper is about average for a country whose economy is where China’s is right now. Its further growth, beyond the mere instalment of copper in the capital stock, will go up along with a growing demand for regular economic innovations. Therefore, China’s copper demand can even be expected to grow from 50 % up to 70% of global demand by 2025.

Another major player in the rapid demand growth of copper could be India. At this point in time, India shows nearly exactly the same rates of urbanisation, power demand and automobile penetration as China showed in 2003 – right before they went on their copper buying binge. Their population is roughly the same as well, 1,35 billion in India versus 1,42 billion people in China. Furthermore, there is a huge political incentive that pushes India towards a higher copper demand. The current government announced its ‘electrification project’, promising every village in the country access to electricity.

The problem with the execution of that promise, up to now, has been that nearly all of those villages are connected to only one electric substation, causing unreliability and massive blackouts. Public outrage made the government promise to invest in a massive growth of the amount of substations. Without multiple access points for electricity in each village, the blackouts will continue. To achieve the goal of full electrification, every single one of these new substations will need copper.

By now, India’s copper demand is over 50,000 tons. It is important to note that when China reached that critical yearly demand many years ago, it went to 100,000 tons/month in a very short time frame. Things can go really fast.

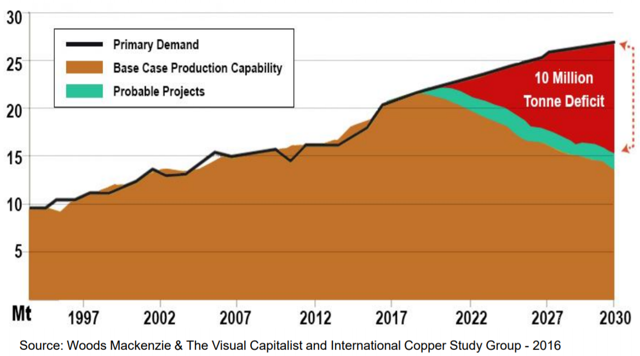

Supply

Confronted with such growing demand, the most interesting question is whether the supply side will be able to cope. Easier said than done. If present trends continue, by 2030 the world is expected to have a copper deficit of 10 million tonnes per year.

As is the case with any mineral, copper needs to be extracted from ore bodies or deposits first. Historically this has mainly been done through the classic mining techniques, sub-surface and surface mining. The former consists of shafts and tunnels in order to reach deposits. The latter is done more nowadays, because it enables to cut down on the amount of labour during the extraction process. Nevertheless, it is still highly capital intensive, especially during its initial production years.

Over the last couple of decades, other factors have contributed to higher costs of regular surface mining. In order to be able to dig up ore, it is inevitable to strip away at least some surface vegetation. Acid of the exposed rock also leaches back into the surrounding ground, bringing along many environmental and legal issues. As the public has become more demanding in terms of environmentally friendly techniques, permits have sometimes been refused for fear that local biodiversity or water quality would be harmed too much when operating the mine.

Therefore, the number of new mines that have been able to come online has been fairly limited, and the All-In Sustaining Cash Cost (AISCC) of copper has gone up. To that we might add factors like union strikes (especially in Chile) or political instability (in Zambia), and the cocktail on the supply side acquires a rather sour taste. The ever more severe regulations, along with the dwindling of ore grades in the existing mines, has made the copper mining business a low-margin field full of uncertainty. If trends continue, many will see themselves forced to stop production. But not all of them …

Excelsior Mining Corp

As mentioned above, surface mining is capital and time intensive, while often being a huge environmental intrusion as well. Yet there is a company that has innovated in the field of mining to such an extent that it beats all expectations, be it in terms of environmental friendliness or costs of production. That company is Excelsior Mining Corp, located in Arizona:

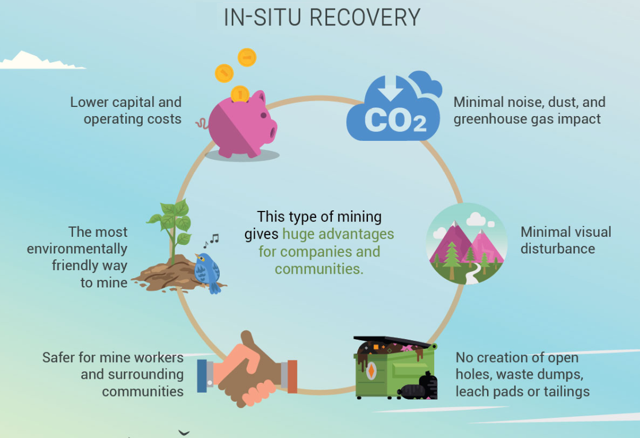

The innovation that MIN.TO brings is to no longer engage in surface mining at all, but to get the ore out of the ground by a technique called “In-situ Recovery” (ISR). This is a process that basically consists of pumping a chemical solution into a closed loop system of injection and recovery wells, surrounded by a field of monitoring wells to make absolutely sure that none of that chemical solution gets into the environment.

This technique actually originated as a way of extracting copper in the Middle Ages, so it is nothing new. But along the way it got forgotten, until it started to be used again, but this time for uranium mining. By re-employing this age-old technique in its original field of application – copper mining – MIN.TOcomes full circle again. We believe that this is a very smart choice, and that MIN.TO will set the standard for many years to come.

The Gunnison Copper Project is located within the copper porphyry belt of Arizona and is the first new U.S. copper project in over a decade. The project is fully permitted and fully financed, with access to over 100 million dollars and backed up by multiple major base metal institutions (such as Triple Flag Mining and Greenstone Resources). It will start with a production of 25 million and ramp up to a projected annual average of 125 million pounds of copper, and a total LOM production of approximately 2165 million pounds.

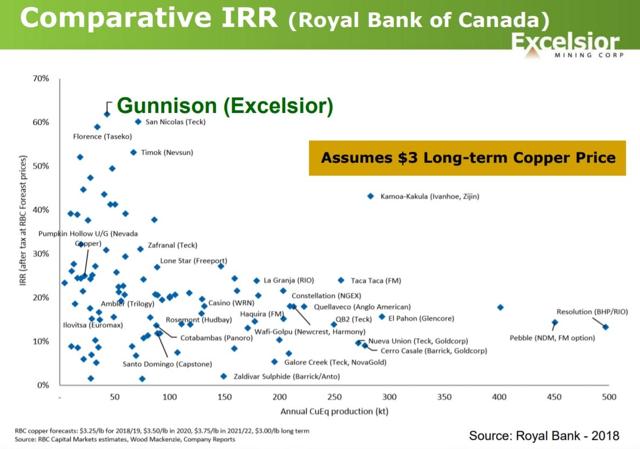

We chose this company as our copper play because Excelsior Mining Corp has the best rate of return for any new copper project coming online while it exhibits the lowest capex at the same time. With an IRR of a whopping 40% (using a copper price of only 2,75 USD) and an initial upfront investment of merely 50 million USD (equally unseen), it reaches post-tax all-in operating cost of an astonishing $1.33.

At the current copper price of $2.70 (July 2019) this means a margin of over 100%, all costs and taxes paid. Even if we take a worst-case scenario into account – copper prices dropping to the lows of 2 dollars, as was the case in early 2016 – then MIN.TO still makes a hefty margin of 61% after all costs and taxes. As such, in our opinion, this truly is a gem waiting to be discovered by the market.

Development (July 2019)

As of present, drilling machines are constructing the required injection, recovery and monitoring wells. When construction will be terminated, the wellfield at the Gunnison Project will eventually consist of 57 wells in total. Due to the site being naturally fractured, the injected weak leach solution will be able to spread through these natural fractures and quite fluently reach the ore body. Construction is going swift, and it is estimated that the first pound of copper will be produced by Q4 of 2019.

The ingenuity of the ISR-method will allow for a rather uneventful process, which is a good thing in terms of risk management. Instead of physically having to go where the minerals are, it brings the minerals to the operators of the mine. When injected, the weak acid solution will make the minerals of the ore body dissolve, after which the solution gets pumped back to the surface to be processed. The mining solution can be recycled and re-used throughout this process, making for very minimal water consumption.

In terms of environmental concerns, it must be stressed that there is absolutely no danger for the contamination of the surrounding water bodies, or even the ground surface. Slightly more groundwater gets pumped out of the wells than solution is injected into it, which lowers the water table and forms a depression. The surrounding groundwater, then, is under greater hydraulic pressure and naturally flows into the depression, which prevents the migration of mining solution into the surrounding ground water. Mining like this is a joy.

Another gift of the location is the limestone rock to the east of the deposit. This rock reacts to acid, and would neutralize any residue should it escape the well field (which will not even be the case). Even when mining is done, and the deposit will be exhausted, the ground will be left clean: through reverse osmosis the acid solution will be replaced with fresh water, and in the end the local water table and environmental surroundings will be restored to their original state. All of this makes for a safe and ecologically friendly process.

Price projection

As of present, the stock stands at 90 cents, which is a bargain given the price it acquired at earlier stages, when financing and permitting risk was not yet out of the way. In April 2018 the stock reached close to 1,5 CAD, which seems like an absolute minimum once the first pound of copper is actually produced. The market is a bit sceptical about whether or not the ISR-method will also work for copper, but after studying the matter, we are convinced that it will, and that this will be a great project.

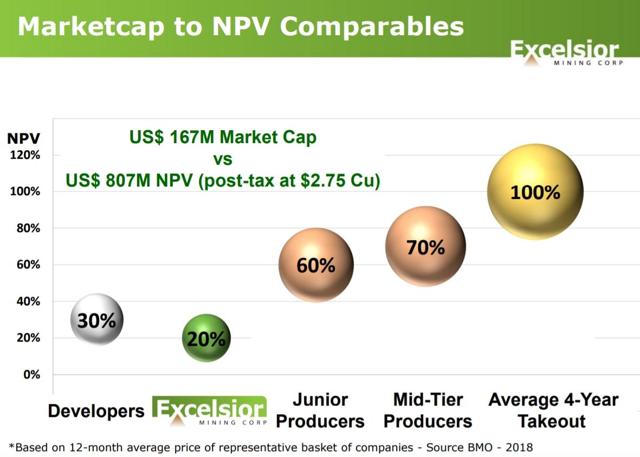

At present, the market cap of MIN.TO is around 220 million, but we are convinced this could someday turn into a billion dollar company – if (and only if) it is not bought out earlier. The problem with the supply of new copper is a problem for the whole of the sector, and a mine presenting such low cost of production is an attractive bride to mid-tier companies seeking to lower their AISCC. Our most conservative price estimate for MIN.TO is 2,2 dollar.

Conclusion

Ticker: MIN.TO

Ticker: MIN.TO

Fully permitted & financed

Market Cap: 220 million

No Debt

Trading Volume: 50 000 shares/day

Current stock price: 0,90CAD

Warrants: 3.5M @ C$1.50 (Exp. 2023)

Price projection: 2,20 CAD

As always, I encourage you to do your own due diligence. For the life of me, I have not been able to find any fundamental weaknesses in this project. But it is always possible that I may have overlooked something. Nevertheless, for those who are convinced about the macro-economics of copper – like I am – the Gunnison Project in Arizona is one of the best plays I can think of.

At an incredibly low cost of production, this company can be profitable in even the most adverse of conditions. On a technical level, it is one of the most innovative projects in the field of mining in a long time. And considering the ecological concerns that are often raised when it comes to mining, I believe this mine can set the standard for a long time to come. In short: once MIN.TOgets online, the copper and the profits will start flowing – literally. The In-situ Recovery method allows for an incredibly low CAPEX and OPEX. An investor’s dream.

My idea is to take advantage while the market is still sleeping. Once this mine will be completed and the first pound of copper will effectively be put on the table, I cannot imagine that it will go unnoticed. By then, however, it will be too late to buy the stock. I can only say that I have taken a first position at 85 cents, and will continue to buy the stock until the end of this year. By then, its fair value will have risen substantially, and the price projection I have put forth has a good chance of becoming reality in the years to come.

Brecht Arnaert

Editor-in-Chief at www.macrotrends.be

Consulted Sources

Excelsior Mining Corp: Annual Information Form

https://www.excelsiormining.com/images/Files/Corporate/Annual_Information/2019MINAIF.pdf

Gunnison Copper Project: Feasibility Study

https://www.excelsiormining.com/images/pdf/Feasibility/43101TechReportGunnison2017.pdf

“Birla Copper sees Indian copper demand doubling by 2026”, consulted on 06/29/2019:

Birla Copper sees Indian copper demand doubling by 2026

“Copper: Driving the Green Energy Revolution”, consulted on 06/29/2019:

Copper: Driving the Green Energy Revolution

“Copper: The Essential Metal”, consulted on 06/29/2019:

Copper: The Essential Metal (Part I)

“Copper price jumps to 9-month high on red-hot China data”, consulted on 06/29/2019:

Copper price jumps to 9-month high on red-hot China data

“Copper statistics and information”, consulted on 06/29/2019:

Copper Statistics and Information

“Copper supply crunch earlier than predicted – experts”, consulted on 06/29/2019:

Copper supply crunch earlier than predicted - experts

“Everything You Need to Know About In-situ Mining”, consulted on 06/29/2019:

Everything You Need to Know About In-Situ Mining

“Excelsior Mining Hydrology Video 2013”, consulted on 06/29/2019:

Excelsior Mining Hydrology Video 2013

“[INFOGRAPHIC] Copper’s impending supply gap”, consulted on 06/29/2019:

[INFOGRAPHIC] Copper's impending supply gap

“JJ Jenex, Excelsior Mining Corp at the March 2-3, 2019 Metals Investor Forum in Toronto.”, consulted on 06/29/2019:

JJ Jennex, Excelsior Mining Corp at the March 2-3, 2019 Metals Investor Forum in Toronto.

Maxim Seredkin, Alexander Zabolotsky, and Graham Jeffress. "In situ recovery, an alternative to conventional methods of mining: Exploration, resource estimation, environmental issues, project evaluation and economics". Ore Geology Reviews, Vol. 79 (2016): 500 - 514.

“Visualizing Copper’s Role in the Transition to Clean Energy”, consulted on 06/29/2019:

Visualizing Copper's Role in the Transition to Clean Energy

“#Bullish on #CopperCu, Adam A. Rozencwajg”, consulted on 06/29/2019:

#Bullish on #CopperCu, Adam A. Rozencwajg

Disclosure: I am/we are long EXMGF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.