Rare earth metals are commodities that may not trade on futures exchanges, but they have a myriad of applications in computers, DVDs, rechargeable batteries, cell phones, catalytic converters, magnets, fluorescent lights and many other products we use in our daily lives.

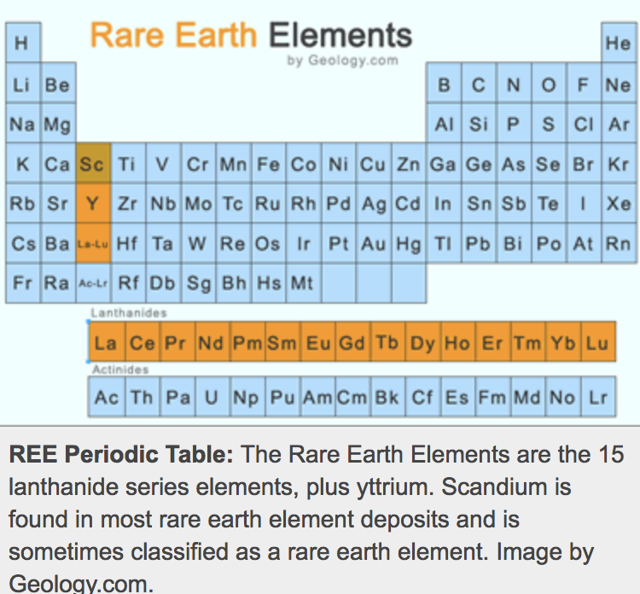

The rare earth sector of the commodities market contains seventeen

chemical elements that occur together on the periodic table.

Source: Geology.com

The chart highlights the members of the sector that has experienced growing demand over the past two decades. Additionally, rare earth metals play a critical role in national defense. Night-vision goggles, precision-guided weapons, communications, and GPS equipment, batteries, and other defense electronics contain these elements. Additionally, jet engines and oil and gas drilling technology contains rare earth elements.

Before 1965, there was little demand for rare earth elements, but the first color television sets used Europium for producing color images which began the exponential demand for the commodities.

The VanEck Vectors Rare Earth/Strategic Metals ETF (REMX) is a market product that seeks to replicate the price action in the rare earth and strategic metals sector. The fund invests at least 80% of its total assets in securities that comprise the MVISA Global Rare Earth/Strategic Metals Index which produce, refine, and recycle the commodities. The ETF construction representing top holdings at total over 70% of the companies contained in the portfolio can be found here. While not explicitly stated, it is likely that the balance of 20% of the ETF is available for opportunities in the market as they arise.

An important bottom has been formed

Time To Buy Rare Earths - REPORT