Deep Value Hidden In The Shares Of Global Self Storage

GLOBAL SELF STORAGE - SELF

NASDAQ

Current Dividend Yield

6.5% - REPORT

Global Self Storage Reports Fourth

Quarter and Full Year 2018 Results

Company Achieves

Dividend Coverage for Third Consecutive Quarter and Full Year 2018

Due to Continued FFO and AFFO Growth

Q4 2018 vs. Q4 2017 Highlights

-

The Company’s total revenues increased 6.6% to $2.1 million,

total expenses increased 2.1% to $1.8 million, and operating

income increased 49.5% to $276,000.

-

Net income totaled approximately $75,000, or $0.01 per fully

diluted share, for the fourth quarter of 2018 compared to net

loss of $21,000, or $0.00 per fully diluted share, for the

fourth quarter of 2017.

-

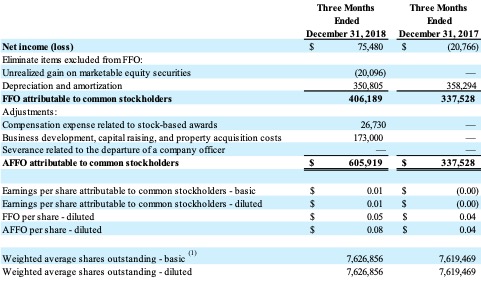

Funds from Operations (“FFO”) and Adjusted FFO (“AFFO”) totaled

$0.05 and $0.08 per share, respectively, for the fourth quarter

of 2018 compared to $0.04 and $0.04 per share, respectively, for

the fourth quarter of 2017. This represents total FFO and AFFO

growth of 20.3% and 79.5%, respectively, for the fourth quarter

of 2018 versus the same time period in 2017.

-

Same-store revenues increased 5.3% to $1.9 million.

-

Same-store net operating income (“NOI”) increased 28.4% to $1.1

million.

-

Combined same-store and non same-store (“Combined store”)

revenues increased 6.6% to $2.1 million.

-

Combined store NOI increased 28.3% to $1.3 million.

-

Combined store leasable square footage at quarter end increased

2.3% to 766,000.

-

Combined store overall square foot occupancy at quarter end

increased 50 basis points to 92.5%.

-

Combined store total annualized revenue per leased square foot

increased 3.6% to $11.71.

-

Maintained quarterly dividend of $0.065 per share of common

stock.

-

The Company’s total revenues increased 8.5% to $8.1 million,

total expenses decreased 1.6% to $6.7 million, and operating

income increased 110.4% to $1.4 million.

-

Net income totaled approximately $619,000, or $0.08 per fully

diluted share, for the full year ended December 31, 2018

compared to net loss of $146,000, or $0.02 per fully diluted

share, for the full year ended December 31, 2017.

-

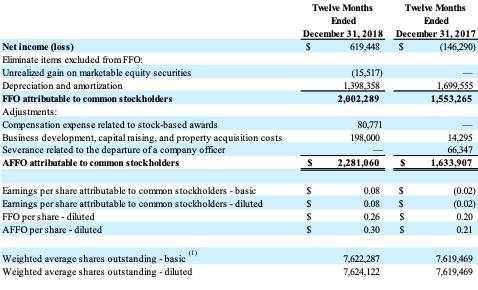

FFO and AFFO totaled $0.26 and $0.30 per share, respectively,

for the full year ended December 31, 2018 compared to $0.20 and

$0.21 per share, respectively, for the full year ended December

31, 2017. This represents total FFO and

AFFO growth of 28.9% and 39.6%, respectively, for the full year

ended December 31, 2018 versus the same time period in 2017.

-

Same-store revenues increased 7.7% to $7.3 million.

-

Same-store NOI increased 11.7% to $4.3 million.

-

Combined store revenues increased 8.6% to $8.1 million.

-

Combined store NOI increased 12.0% to $4.8 million.

-

Combined store total annualized revenue per leased square foot

increased 5.5% to $11.46.

-

Distributed dividends of $0.26 per share of common stock.

-

Capital resources totaled $3.1 million, comprised of $1.5

million of cash and cash equivalents and $1.6 million of

marketable securities. In addition, the Company secured a $10

million revolving credit line facility in December 2018, with

interest payable at one-month LIBOR plus 3.00%.

“Our results for the fourth quarter

demonstrated once again our continued success in driving same-store

revenue growth, maintaining expenses, and significantly expanding

NOI from our properties,” said President and Chief Executive Officer

of the Company, Mark C. Winmill. “We

achieved record results in both the quarter and year, but more

importantly, achieved full dividend coverage from FFO and AFFO for

the full year of 2018—a significant milestone in our journey of

maximizing shareholder value. Driving this achievement was our

ability to continue successfully increasing rental rates, while

managing our costs and maintaining our preferred 90%+ occupancy

levels.”

The Company’s fourth quarter total

revenues increased 6.6%, total expenses increased 2.1%, and

operating income increased 49.5%. The increase in operating income

was driven primarily by the expansion of the Company’s Merrillville,

IN store, as well as higher rental and occupancy rates. For the

fourth quarter of 2018, net income totaled $75,000 compared to net

loss of $21,000 for the fourth quarter of 2017.

The Company's same-store portfolio for

the fourth quarter of 2018 included ten of its eleven stores,

representing 87.2% of store NOI for the quarter.

For the fourth quarter of 2018, Combined

store revenues increased 6.6% to $2.1 million compared with $1.9

million for the fourth quarter of 2017. The increase was driven

primarily by a 2.9% increase in net leased square footage and by the

results of the Company’s revenue rate management program of raising

existing tenant rates. The increase in net leased square footage was

a result of the Company’s Merrillville, IN store expansion, which

was completed in January 2018.

Net income totaled approximately $75,000,

or $0.01 per share, in the fourth quarter of 2018 compared to a net

loss of $21,000 or $0.00 per share, for the fourth quarter of 2017.

FFO and AFFO for the Fourth Quarter of 2018

(1) For purposes of calculating FFO and AFFO per share, unvested

restricted stock is not included.

Full Year Ended December 31, 2018

The Company’s total revenues for the full

year ended December 31, 2018 increased 8.5%, total expenses

decreased 1.6%, and operating income increased 110.4%. The increase

in operating income was driven primarily by the expansion of the

Company’s Merrillville, IN store, as well as higher rental and

occupancy rates. For the full year ended December 31, 2018, net

income totaled $619,000 compared to a net loss of $146,000 for the

same period in 2017.

Same-Store Results for the Full Year

Ended December 31, 2018

The Company's same-store portfolio for

the full year ended December 31, 2018 included ten of its eleven

stores, representing 88.1% of store NOI for the period.

Same-store operating expenses for the

full year ended December 31, 2018 totaled $3.0 million compared with

$2.9 million for the full year ended December 31, 2017. The increase

was primarily driven by higher store level employment costs and

administrative expenses, which were partially offset by reduced

advertising and marketing costs and reduced property taxes as

described above. The Company currently expects same-store property

tax expenses to increase during 2019, primarily due to an expected

phaseout of the Class 8 tax incentive granted to the Dolton, IL

property.

For the full year ended December 31,

2018, Combined store revenues increased 8.6% to $8.1 million

compared with $7.5 million for the full year ended December 31,

2017. The increase was driven primarily by a 2.9% increase in net

leased square footage, due primarily to the Merrillville, IN

property expansion, and by the results of the Company’s revenue rate

management program of raising existing tenant rates.

Net income totaled approximately

$619,000, or $0.08 per fully diluted share, for the full year ended

December 31, 2018 compared to a net loss of $146,000 or $0.02 per

fully diluted share, for the full year ended December 31, 2017.

(1) For purposes of calculating FFO and

AFFO per share, unvested restricted stock is not included.

On December 3, 2018, the Company declared

a quarterly dividend of $0.065 per share, consistent with the

quarterly dividend from a year ago and last quarter.

At December 31, 2018, cash, cash

equivalents, and marketable equity securities totaled $3.1 million

compared with $3.7 million at December 31, 2017.

Global Self Storage, Inc. is a

self-administered and self-managed REIT that owns, operates,

manages, acquires, develops and redevelops self storage properties

in the United States. The Company's self storage properties are

designed to offer affordable, easily accessible and secure storage

space for residential and commercial customers. It currently owns

and operates, through its wholly owned subsidiaries, eleven self

storage properties located in Connecticut, Illinois, Indiana, New

York, Ohio, Pennsylvania, and South Carolina. For more information,

go to

http://ir.globalselfstorage.us/

or visit our self storage customer site at

www.globalselfstorage.us.

You can also follow us on

Twitter,

LinkedIn

and

Facebook.

This press release contains certain

non-GAAP financial measures. FFO and FFO per share are non-GAAP

measures defined by the National Association of Real Estate

Investment Trusts (“NAREIT”) and are considered helpful measures of

REIT performance by REITs and many REIT analysts. NAREIT defines FFO

as a REIT’s net income, excluding gains or losses from sales of

property, and adding back real estate depreciation and amortization.

FFO and FFO per share are not a substitute for net income or

earnings per share. FFO is not a substitute for GAAP net cash flow

in evaluating our liquidity or ability to pay dividends, because it

excludes financing activities presented on our statements of cash

flows. In addition, other REITs may compute these measures

differently, so comparisons among REITs may not be helpful. However,

the Company believes that to further understand the performance of

its stores, FFO should be considered along with the net income and

cash flows reported in accordance with GAAP and as presented in the

Company’s financial statements.

AFFO represents FFO excluding the effects

of business development and acquisition related costs and

non-recurring items, which we believe are not indicative of the

Company’s operating results. We present AFFO because we believe it

is a helpful measure in understanding our results of operations

insofar as we believe that the items noted above that are included

in FFO, but excluded from AFFO, are not indicative of our ongoing

operating results. We also believe that the investment community

considers our AFFO (or similar measures using different terminology)

when evaluating us. Because other REITs or real estate companies may

not compute AFFO in the same manner as we do, and may use different

terminology, our computation of AFFO may not be comparable to AFFO

reported by other REITs or real estate companies.

We believe net operating income or “NOI”

is a meaningful measure of operating performance because we utilize

NOI in making decisions with respect to, among other things, capital

allocations, determining current store values, evaluating store

performance, and in comparing period-to-period and market-to-market

store operating results. In addition, we believe the investment

community utilizes NOI in determining operating performance and real

estate values, and does not consider depreciation expense because it

is based upon historical cost. NOI is defined as net store earnings

before general and administrative expenses, interest, taxes,

depreciation, and amortization. A reconciliation of this measure to

its most directly comparable GAAP measure is provided later in this

release.

NOI is not a substitute for net income,

net operating cash flow, or other related GAAP financial measures,

in evaluating our operating results.

We consider our same-store portfolio to

consist of only those stores owned and operated on a stabilized

basis at the beginning and at the end of the applicable periods

presented. We consider a store to be stabilized once it has achieved

an occupancy rate that we believe, based on our assessment of market

specific data, is representative of similar self storage assets in

the applicable market for a full year measured as of the most recent

January 1 and has not been significantly damaged by natural disaster

or undergone significant renovation or expansion. We believe that

same-store results are useful to investors in evaluating our

performance because they provide information relating to changes in

store-level operating performance without taking into account the

effects of acquisitions, dispositions or new ground-up developments.

At December 31, 2018, we owned ten same-store properties and one non

same-store property. The Company believes that by providing

same-store results from a stabilized pool of stores, with

accompanying operating metrics including, but not limited to

variances in occupancy, rental revenue, operating expenses, NOI,

etc., stockholders and potential investors are able to evaluate

operating performance without the effects of non-stabilized

occupancy levels, rent levels, expense levels, acquisitions or

completed developments. Same-store results should not be used as a

basis for future same-store performance or for the performance of

the Company's stores as a whole.

Certain information presented in this

press release may contain “forward-looking statements” within the

meaning of the federal securities laws

including, but not limited to, the

Private Securities Litigation Reform Act of 1995. Forward looking

statements include statements concerning the Company’s plans,

objectives, goals, strategies, future events, future revenues or

performance, capital expenditures, financing needs, plans or

intentions, and other information that is not historical

information. In some cases, forward looking statements can be

identified by terminology such as “believes,” “plans,” “intends,”

“expects,” “estimates,” “may,” “will,” “should,” “anticipates,” or

the negative of such terms or other comparable terminology, or by

discussions of strategy. All forward-looking statements by the

Company involve known and unknown risks, uncertainties and other

factors, many of which are beyond the control of the Company, which

may cause the Company’s actual results to be materially different

from those expressed or implied by such statements. The Company may

also make additional forward looking statements from time to time.

All such subsequent forward-looking statements, whether written or

oral, by the Company or on its behalf, are also expressly qualified

by these cautionary statements. Investors should carefully consider

the risks, uncertainties, and other factors, together with all of

the other information included in the Company’s filings with the

Securities and Exchange Commission, and similar information. All

forward-looking statements, including without limitation, the

Company’s examination of historical operating trends and estimates

of future earnings, are based upon the Company’s current

expectations and various assumptions. The Company’s expectations,

beliefs and projections are expressed in good faith, but there can

be no assurance that the Company’s expectations, beliefs and

projections will result or be achieved. All forward looking

statements apply only as of the date made. The Company undertakes no

obligation to publicly update or revise forward looking statements

which may be made to reflect events or circumstances after the date

made or to reflect the occurrence of unanticipated events. The

amount, nature, and/or frequency of dividends paid by the Company

may be changed at any time without notice.

Contacts:

Global Self Storage, Inc.

Mark C. Winmill

President and Chief Executive Officer

1-212-785-0900, ext. 201

Liolios Investor Relations

Scott Liolios or Najim Mostamand, CFA

1-949-574-3860

###

Global Self Storage, Inc.

(Unaudited)

Global Self

Storage, Inc.

Consolidated Statements of Operations

(Unaudited)

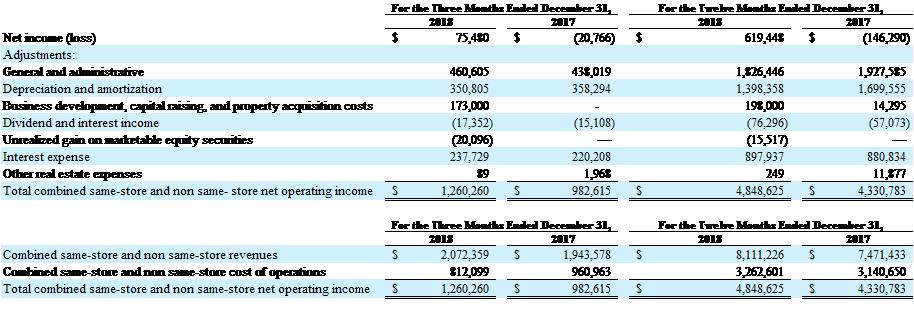

Reconciliation of

GAAP Net Income (Loss) to Same-Store Net Operating Income

The following table presents a

reconciliation of same-store net operating income to net income

(loss) as presented on our unaudited consolidated statements of

operations for the periods indicated:

Reconciliation of

GAAP Net Income (Loss) to Combined Same-Store and Non Same-Store Net

Operating Income

The following

table presents a reconciliation of combined same-store and

non same-store net operating income to net income (loss) as

presented on our unaudited consolidated statements of operations for

the periods indicated: