Aurora Cannabis (ACB) reported fiscal 2019 fourth-quarter results that disappointed investors, sending its share tumbling 9% that day. The company sold more cannabis in Canada than Canopy did but its EBITDA remains a negative $11 million. We think Aurora's struggle with profitability reflects the general malaise facing the entire Canadian cannabis market. A messy rollout of retail stores in Ontario and significant initial undersupply has gotten the legal market into a slow start. LPs have also under-delivered on their production schedules and Aurora has only recently reached a certain level of scale in search of profitability. We think the company needs to continue executing and improving its profitability before one could reasonably assess its valuation. We remain Neutral on the stock due to its speculative market cap.

Buffetts Mistakes - Oracle Of Omaha Skips A Beat - Shorts Scramble On Goldman Research Report ALYI

2019 Q4 Review

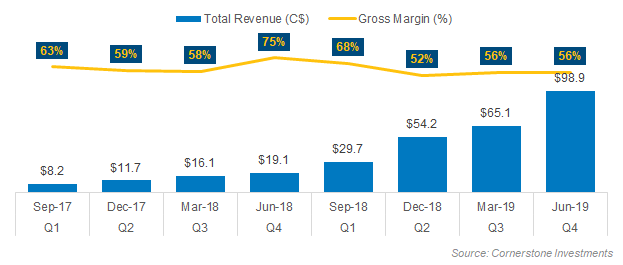

Aurora reported fiscal 2019 Q4 results for the three months ended on June 30, 2019. The quarter showed tremendous revenue growth but margin and cash flow disappointed investors. The company managed to grow revenue by 52% from last quarter driven primarily by higher harvest and sales into the adult market. However, the company faced an embarrassing moment when its reported revenue missed its own guidance provided just one month ago, due to internal omissions related to non-cannabis revenue. Medical sales grew slightly in the quarter but the market seems to have little room for further growth in Canada. Aurora sold $45 million worth of cannabis into the adult market which is up from $30 million last quarter. However, the company couldn't sell everything into the direct distribution channels and had to dump $20 million worth of cannabis into the wholesale market.

CBD Wellness Line - Vape Pens Refil Pods - NewLeaf Brands Up News

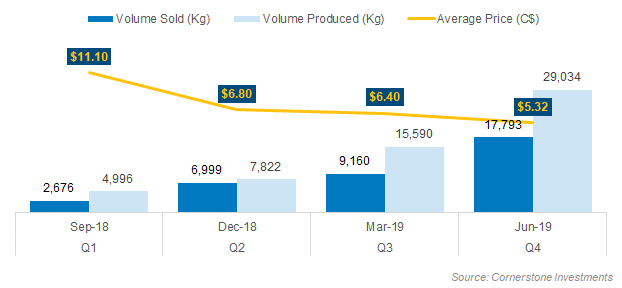

Average selling prices dropped considerably due to large volumes sold into the wholesale market. Wholesale prices averaged $3.61 per gram which is significantly lower than other channels. Medical cannabis selling prices averaged at $8.51 per gram which is unchanged from the prior quarter. Meanwhile, adult cannabis prices declined slightly to $5.14 per gram. Aurora continues to ramp up its production and harvest totaled 29,000 kg in the quarter, helped primarily by the full commissioning of Aurora Sky. We expect Aurora to continue expanding its production as it moves towards its stated target of 625,000 kg per year by the calendar year 2020.

(Source: Public Filings)

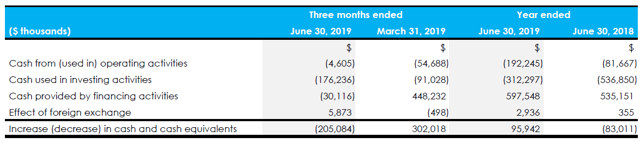

Aurora took steps to shore up its balance sheet during the quarter as operations remain unprofitable and cash flow negative. The company sold all its remaining shares in The Green Organic Dutchman (OTCQX:TGODF) for $87 million. It also upsized its credit facility with BMO to $360 million under which it currently has a borrowing of $140 million. The reason for the cash-raising activities is that Aurora does not have the luxury of a CPG partner bankrolling them with billion-dollar investments. Both Canopy (CGC) and Cronos (CRON) are flush with cash and they won't need to raise new capital anytime soon. On the other hand, Aurora only reported $316 million of cash on hand last quarter which is barely comfortable given that it burned through $200 million of cash last quarter from operating and investing cash flows. The good news is that cash flow from operation seems to have stabilized last quarter and adjusted EBITDA was a loss of $11 million, a substantial improvement from $36 million loss the prior quarter.

(Source: Company Filings)

Valuation

Aurora currently has a market cap of $8 billion and trades at 21x EV/Sales based on its latest quarter. The company is trading in-line with Canopy at 29x and Tilray at 19x. Cronos remains the outlier with its outrageous 84x EV/Sales mainly due to its meager sales - expect its sales to ramp up after acquisition of U.S. CBD company Redwood. It is notable that Aurora's sales eclipsed Canopy last quarter, taking over the crown as Canada's biggest cannabis company by revenue. We expect Aurora's momentum in Canada to continue as its production continues to scale and its products continue to sell well in the adult market. For example, CannTrust's (CTST) demise will help Aurora get more medical patients in Canada.

(Source: TSX)